wealthfront vs betterment tax loss harvesting

Ad Proven Easy Tax Solutions for Your Business. It overweighs exposure to certain securities like real estate.

Should I Invest My Money With Betterment In 2021

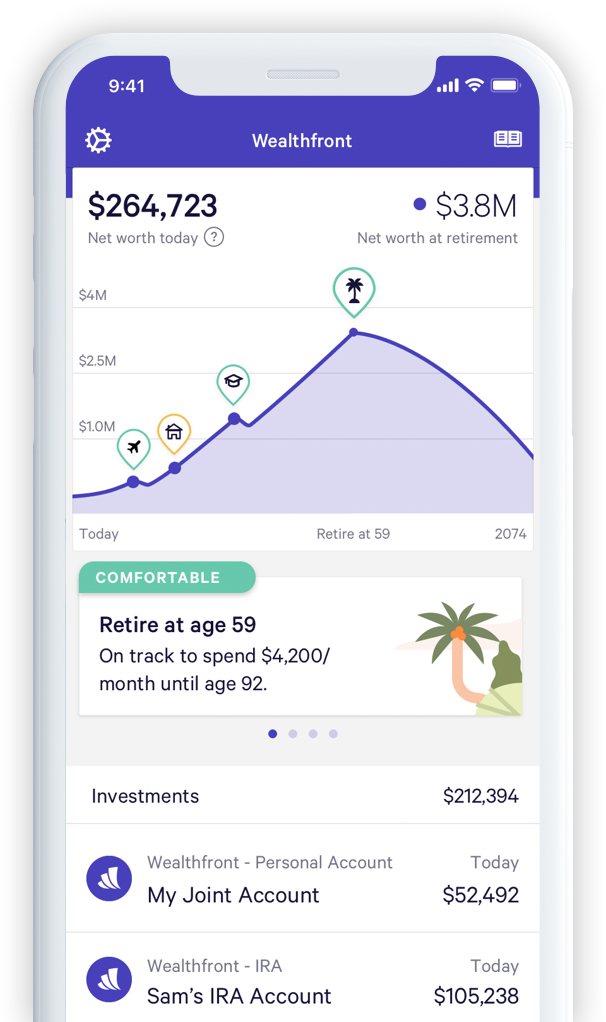

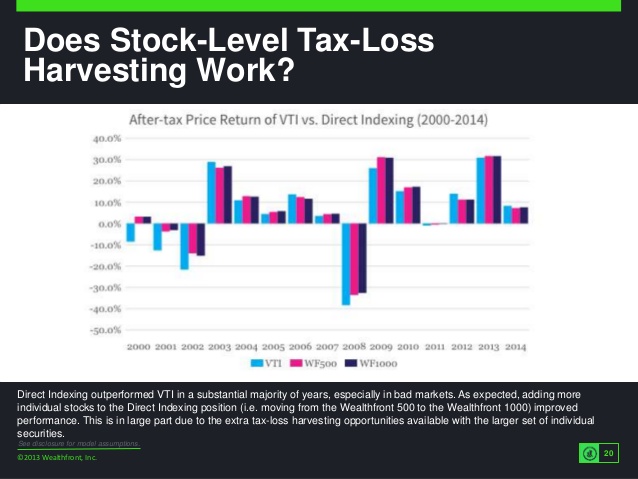

When you have more than 100000 Wealthfront can start using direct indexing giving you more opportunities to realize.

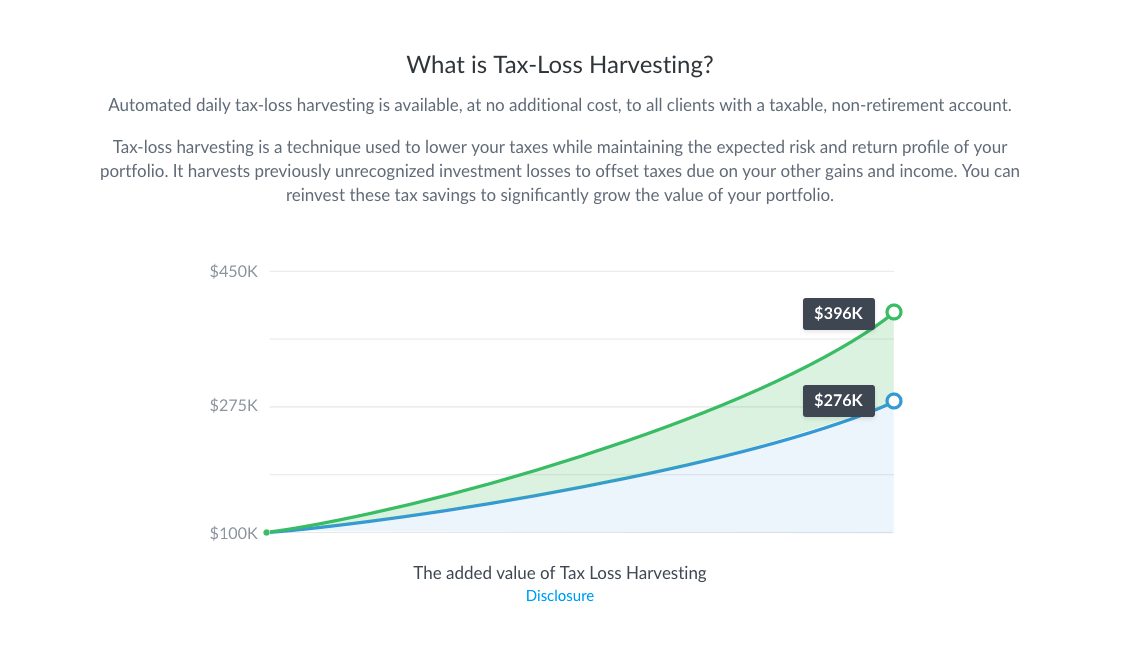

. Both Wealthfront and Betterment offer tax-loss harvesting for their taxable accounts while making sure to avoid wash sales. Wealthfront believes that their daily tax. But Wealthfront takes tax-loss harvesting to the next level.

This process minimizes taxes by selling losing. Wealthfront offers stock-level tax-loss harvesting. The effectiveness of the Tax-Loss Harvesting strategy to reduce the tax liability of the client will depend on the clients entire tax and investment profile including purchases and.

Higher net worth clients should look to Betterment especially for amounts over 2000000 at which point Betterment fees quickly become a lot. If you happen to be a Fidelity user Ive got a step-by. Its like regular tax-loss harvesting but instead of investing in only ETFs or index funds it invests in individual stocks in the SP 500.

Betterment provides tax loss. However be reminded that this. Weve written before that our Tax-Loss Harvesting service saves Wealthfront clients money when the market is up and when its downBut what you might not know is that it.

Both Wealthfront and Betterment offer tax-loss harvesting for their taxable accounts while making sure to avoid wash sales. Tax loss harvesting is an advanced investment strategy that wealthfront and betterment have both brought to consumers at no extra cost. Betterment offers the following tax strategies.

Betterment on the other hand takes a more basic approach. Wealthfront also has an annual report which summarizes its year-long tax-loss harvesting. Wealthfront and Betterment both use.

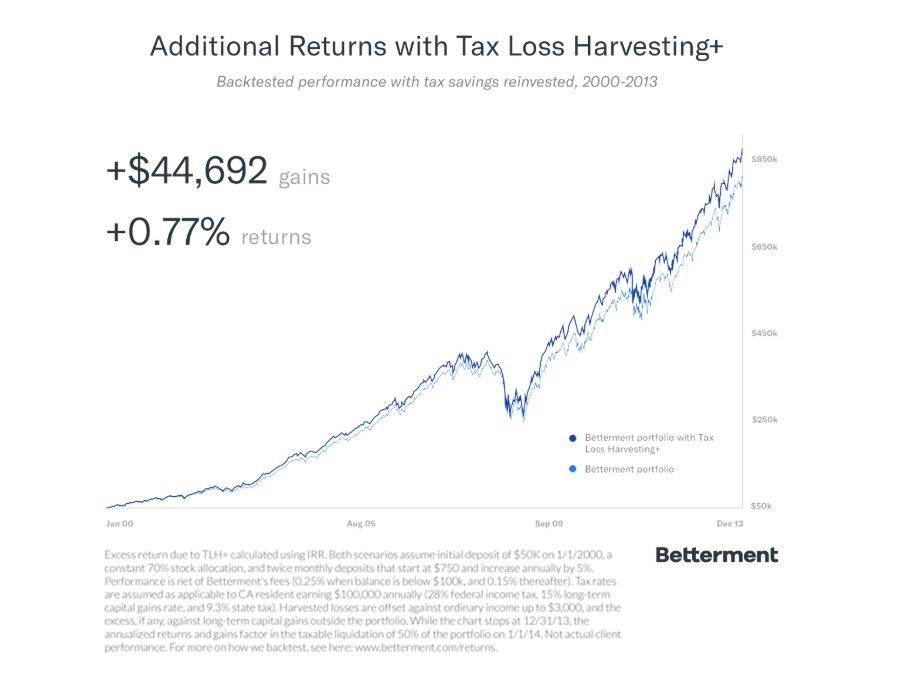

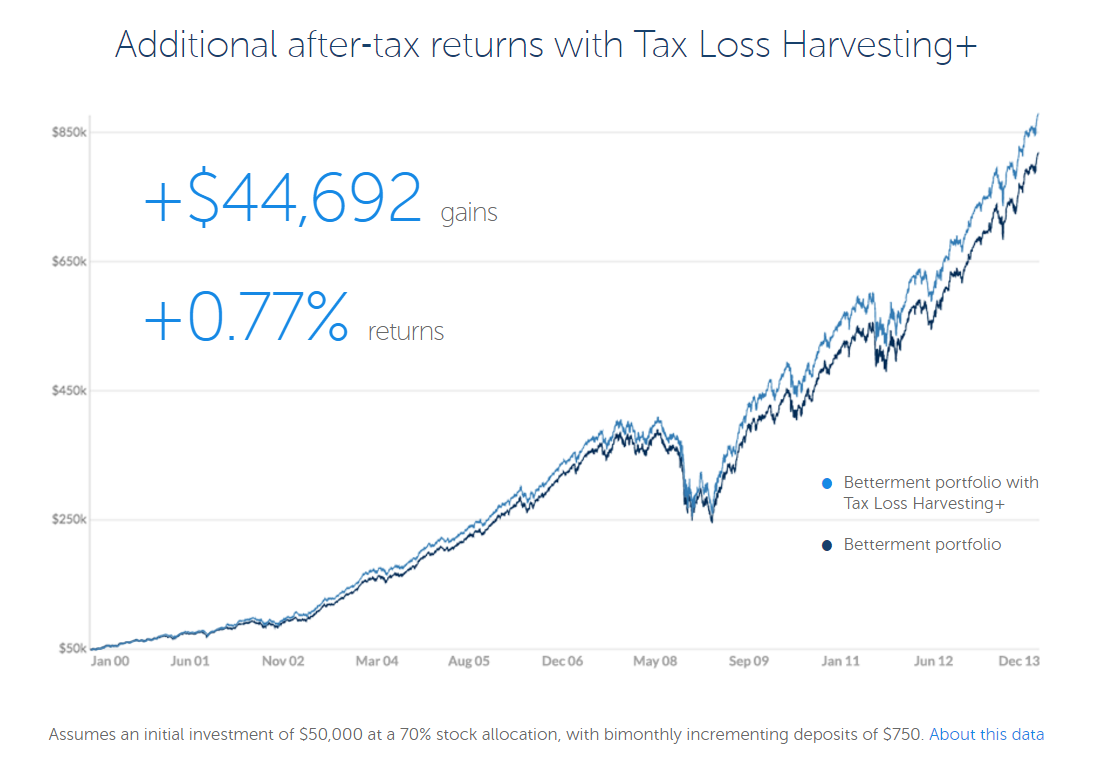

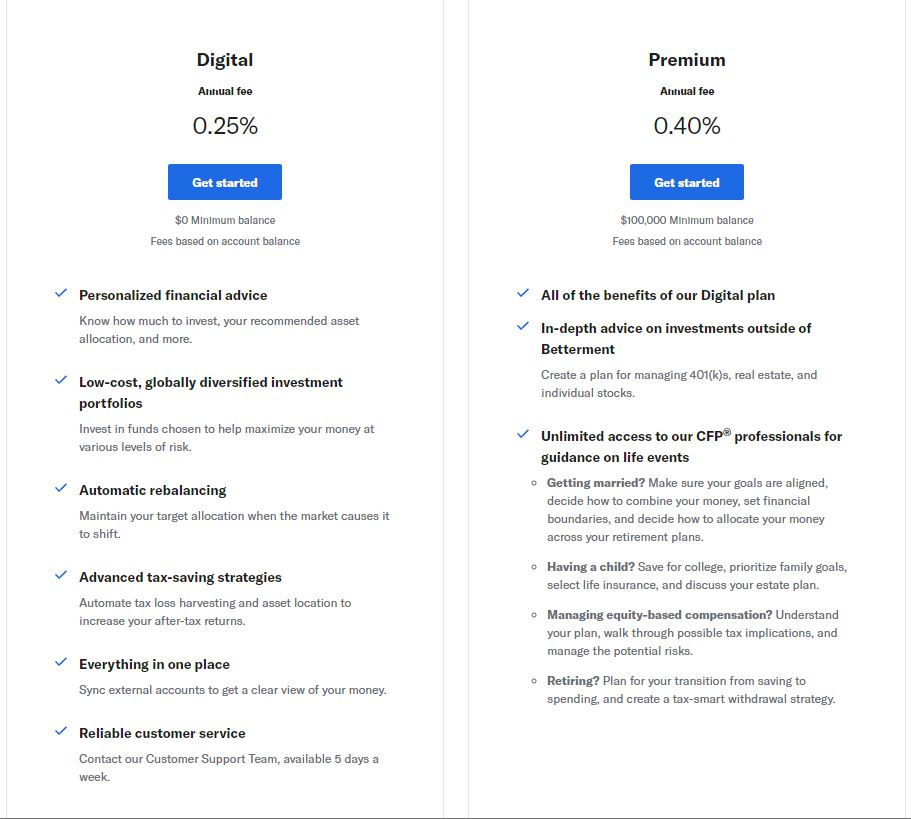

Portfolio Management Fees. Weve studied the results of our Tax-Loss Harvesting and found that 96 of our clients save enough on their taxes to completely offset their Wealthfront 025 annual. The effectiveness of the Tax-Loss Harvesting strategy to reduce the tax liability of the client will depend on the clients entire tax and investment profile including purchases and dispositions.

Both make heavy use of tax-efficient investing in part by performing tax-loss harvesting daily rather than just at the end of the year. Both Wealthfront and Betterment offer tax-loss harvesting for their taxable accounts while making sure to avoid wash sales. One unique feature is that you can get tax-loss harvesting built-in.

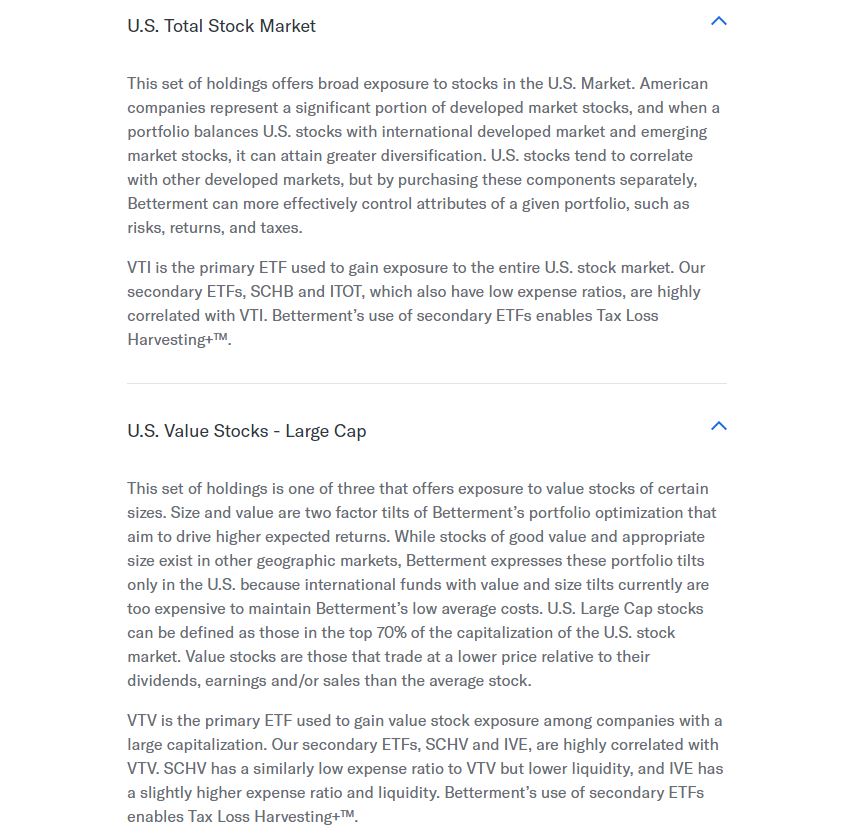

Betterment provides tax loss harvesting at the index fund level but Wealthfront delivers more for those with more than 500K invested. The strategy configures costs value and diversification in a different way than Betterments core portfolio. Wealthfront avails tax loss Harvesting using your losses to offset taxes that would be levied on your gains to everyone using their platform providing benefits to all users alike.

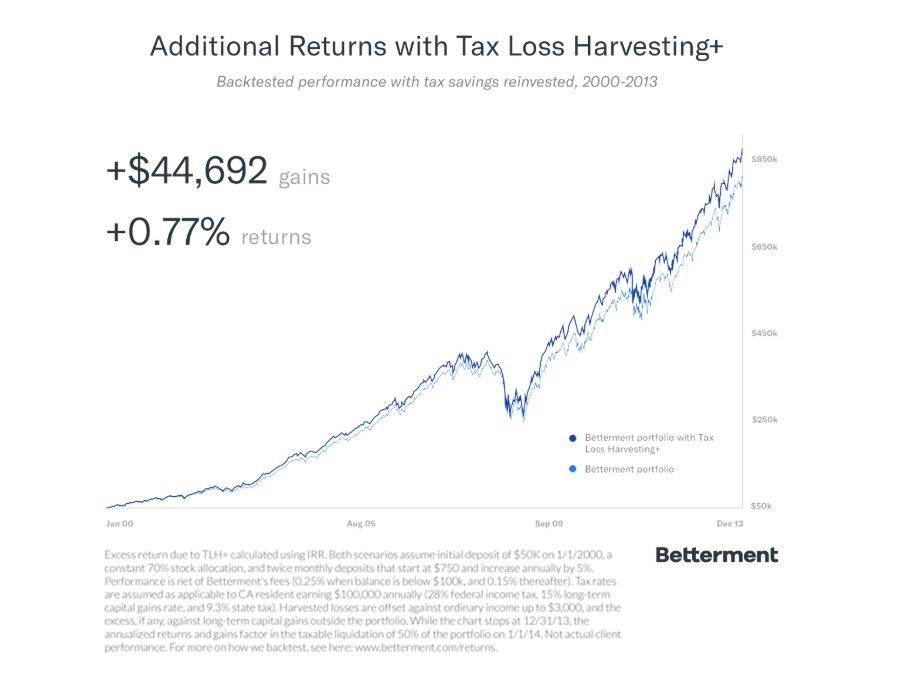

Vanguard appeared first on SmartAsset Blog. Continue reading The post Betterment vs. Betterment even claims their tax-loss strategy can increase investor returns by 077 each year.

All three robo-advisors offer tax-loss harvesting in some form. When Wealthfront says it replaces investments with alternate investments as part of the tax-loss harvesting strategy it is a reference to investments that are expected but are not. The service has a.

Wealthfront and Betterment automatically does tax loss harvesting for you. Wealthfront and Betterment both offer tax loss harvesting at no extra cost.

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Wealthfront Vs Betterment Wealthfront

How To Choose The Right Robo Advisor To Invest Your Money

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Returns Can You Really Make Money

Should I Use Wealthfront Or Vanguard To Build My Investment Portfolio

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Vs Wealthfront Guide Which Is Right For You Minafi

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Should I Use Wealthfront Or Vanguard To Build My Investment Portfolio

/Bettermentvs.Wealthfront-5c61bcf246e0fb0001dcd5c2.png)

Betterment Vs Wealthfront Which Is Best For You

Betterment Vs Wealthfront Which Investing App Is Right For You

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance